Latino Founders Are Fueling America’s Future - Why Aren’t We Investing?

“Latino entrepreneurs are not just building businesses, they are building the future of America.” - Sol Trujillo

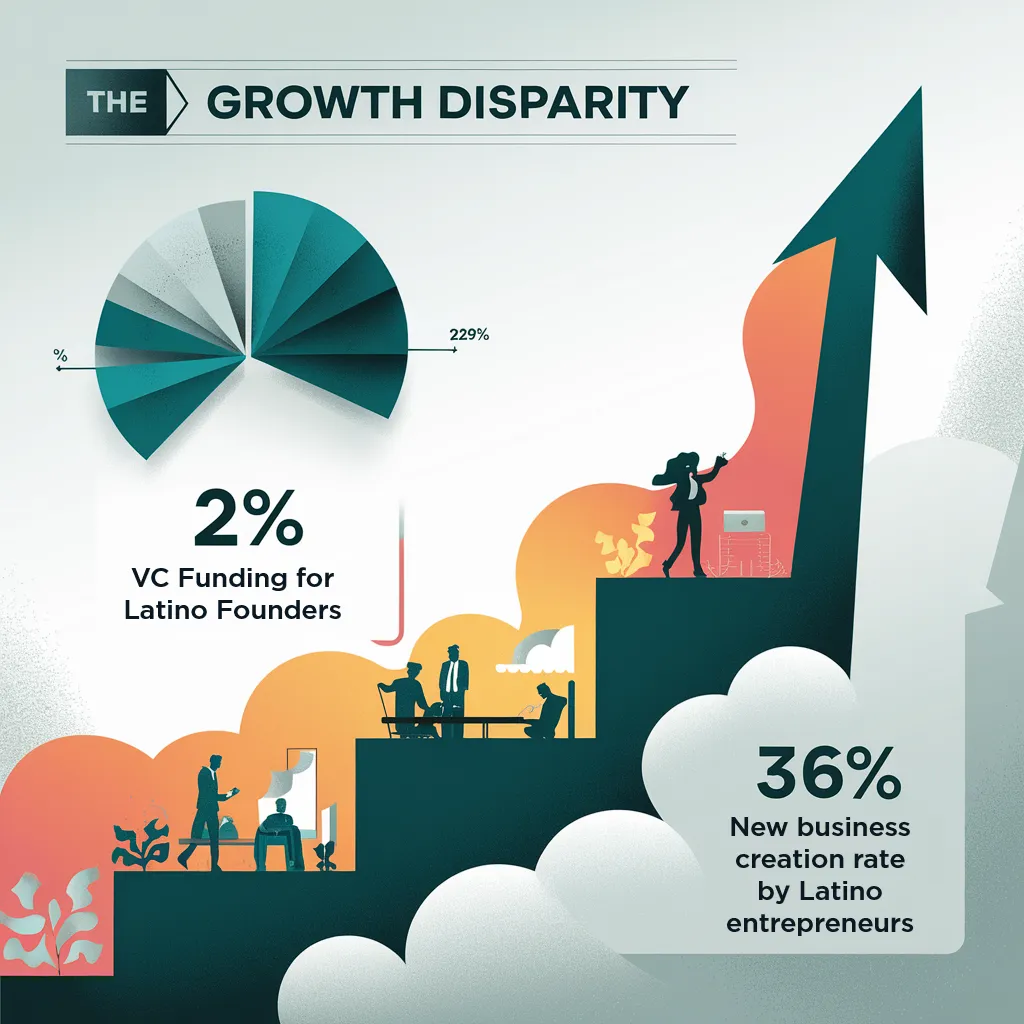

As I join fellow investors at the Angeles Investors 2Q Summit this week, I'm carrying with me a statistic that should spark urgency across America's innovation economy: less than 2% of venture capital funding reaches Latino founders. This isn't just a number on a spreadsheet, it represents the most significant missed opportunity in American entrepreneurship today.

Latino-led startups are the fastest-growing segment of entrepreneurship in the U.S., outpacing growth across nearly every industry. The Latino community is not just participating in the economy, we are powering it. According to the Latino Donor Collaborative, if U.S. Latinos were a stand-alone economy, we would rank as the fifth-largest GDP in the world. We are driving growth, creating jobs, and leading innovation across industries; yet we remain dramatically undercapitalized. This disconnect should spark urgency, not only because it reflects inequity but because it threatens our collective economic potential. Investors and decision-makers must ask themselves: what innovation, talent, and market advantage are we leaving on the table?

The Growth Engine Hiding in Plain Sight

While venture capital overlooks Latino founders, the data tells a different story about who's actually driving America's entrepreneurial future. Latino-led startups are the fastest-growing segment of entrepreneurship in the United States, outpacing every other demographic group. In 2023 alone, Latino entrepreneurs launched 36% of all new businesses in America; a testament to relentless drive and innovation that demands attention.

The numbers are staggering: Over the past five years, Latino-owned businesses surged by 44%, even as white-owned businesses slightly declined. Today, approximately five million Latino-owned businesses generate over $800 billion in annual revenue and employ millions of Americans. These aren't just corner stores or service businesses; Latino entrepreneurs are building scalable companies in technology, AI, climate solutions, health tech, and beyond.

Yet despite this extraordinary growth trajectory, the funding gap persists. While Latinos represent nearly one-fifth of the U.S. population, we receive less than 2% of venture capital dollars. In some years, that share has dipped below 1%. This disconnect isn't about pipeline or preparedness, it's about systemic barriers that prevent capital from reaching America's most dynamic entrepreneurs.

The Real Cost of this Gap

The economic implications extend far beyond individual startups. If Latino-owned businesses grew at the same rate as the U.S. average, they could add $1.4 trillion to the economy - nearly an 8% boost to current GDP. Consider this: Latino-owned businesses are already responsible for almost two-thirds of all new jobs in America and nearly half of private-sector output. Imagine what's possible when we remove the capital constraints.

Beyond the Bias: Smart Economics

This funding disparity forces 70% of Latino entrepreneurs to rely on personal savings for initial funding, while facing lower approval rates for business loans over $50,000 compared to white counterparts. But here's what investors miss: backing Latino founders isn't about charity or checking diversity boxes, it's about smart economics.

Studies consistently show that diverse founding teams outperform their peers in profitability and innovation. Venture capital firms that diversify their portfolios see higher returns. Latino entrepreneurs bring unique market insights, cultural understanding, and problem-solving approaches that create competitive advantages in increasingly diverse markets.

Progress in Motion

Organizations like Angeles Investors, are working to close this gap by providing capital, mentorship, and visibility to Latino founders. The Google for Startups Latino Founders Fund and similar initiatives are empowering entrepreneurs to harness cutting-edge technologies and scale their impact. These efforts matter, but they need amplification across the entire investment ecosystem.

Action Station

As I join investors and advocates tomorrow, I bring this urgent message: It's time to bet on Latino brilliance.

To my fellow investors: Look beyond traditional networks. Examine how implicit bias may be impacting your deal flow and investment decisions. Seek out Latino-led startups and commit to funding the future that's already being built.

To corporate leaders and accelerators: Develop partnerships that intentionally include Latino founders. Build inclusive ecosystems that nurture diverse innovation from seed to scale.

To Latino entrepreneurs: Keep building. Keep pushing. Your innovation is vital, your impact is measurable, and your voice is powerful. The tide is turning and you are the current driving change.

To all of us: Let’s recognize that the future of American entrepreneurship is diverse, driven, and distinctly Latino. It’s time to close the gap between potential and capital. Let’s make equity the engine behind the next wave of economic growth.

The opportunity is unprecedented. Latino entrepreneurs are launching businesses faster than any other group, creating jobs at remarkable rates, and building solutions to real-world problems with bold innovation. The question isn't whether Latino-led startups represent good investments; the data proves they do. The question is whether we'll act on that evidence.

Supporting Latino entrepreneurs is investing in job creation, innovation, and shared prosperity. It's recognizing that the future of American entrepreneurship is diverse, driven, and distinctly Latino.

The growth engine is here. The potential is proven. The time is now!

Let's ensure that when we gather at next year's summit, we're celebrating progress, inclusion, and the unleashing of America's full entrepreneurial potential. Because when Latino founders succeed, America succeeds. Here’s to building a more inclusive, innovative, and equitable future, together.

Until next time, let’s keep pushing for progress and investing in the future we believe in.